How to give appreciated stock to Center for Safety & Change

To complete your stock donation please transfer your shares to our brokerage account listed below:

Name of receiving firm: Pershing LLC

DTC no of receiving firm: 0443

Account name: Center for Safety & Change, Inc.

Account number: # 5W8094976

Contact development@centersc.org with any questions, or call (845) 634-3391.

Giving appreciated securities (shares of common stock or units of mutual funds) provides tax benefits to you and direct support to Center for Safety & Change.

Appreciated securities are those that are worth more today than when they were acquired. Capital gains are the difference between the current value and the value it had when acquired. When selling appreciated securities that have been held for at least one-year, federal taxes are due on the capital gains, and many states also charge capital gains taxes.

For example, Donor A owns 700 shares of a publicly traded stock that is currently trading at $100 per share, and purchased for $10 per share some years ago:

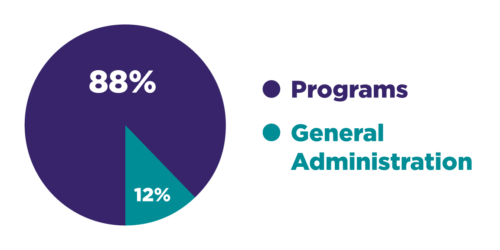

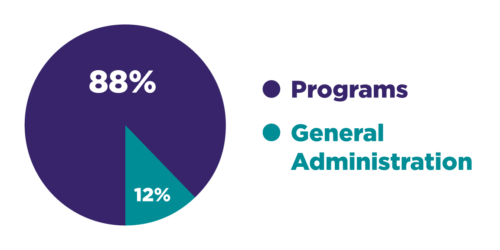

Learn how your gift will be used:

To learn more about how your gift will be used, read more about our work, our impact or view our financial information including our latest financial statements.

Questions?

Email development@centersc.org or call (845) 634-3391.